A credit utilization calculator is a free tool created for those who are looking for the best banking offer for any credit type.

A credit utilization calculator is a free tool created for those who are looking for the best banking offer for any credit type. Banks offer so many different products that finding the most suitable one takes a lot of time and requires tedious calculations, which sometimes significantly differ from a bank’s real offer.

Amounts offered by banks may differ by 50% or more; sometimes really huge amounts are at stake, so the game is worth the candle. To use all this data in specific calculations, we apply loan calculators.

How does the loan calculator work?

The technology implemented in the calculators makes it possible to compare available banks’ credit offers in just a few seconds and group them into series of offers from the most profitable to the least profitable. After checking the offers, a potential client already knows which offers to focus on and which banks to consider when planning a visit to a particular bank. You can’t do without visiting a bank office – at least to get answers to particular questions about the offer you are interested in.

How to calculate the credit utilization rate

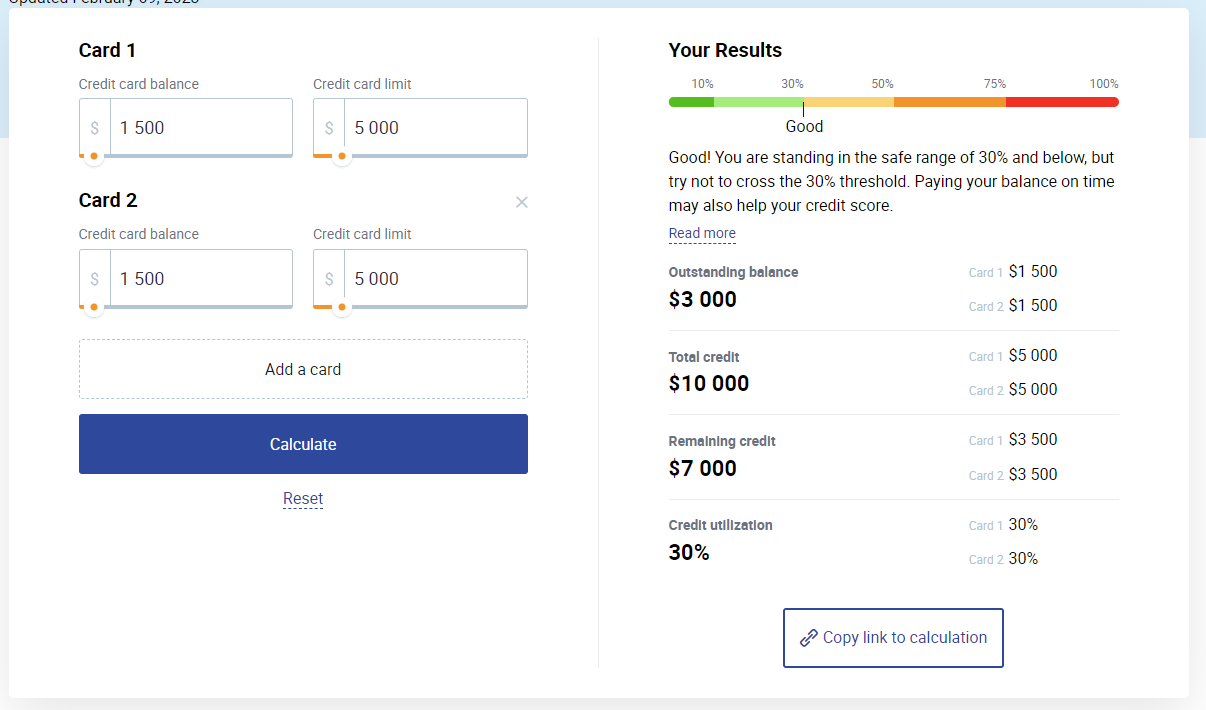

You can calculate the credit utilization rate yourself using this formula:

- Add up the balances on all your credit cards.

- Add up the credit limits of all your cards.

- Divide the total balance by the total credit limit.

- Multiply by 100 to see the credit utilization rate as a percentage.

For example, let’s suppose you have two credit cards with $500 on each of the accounts. The credit limit of one card is $2,000 and the other’s is $3,000. This gives us a 20% rate of credit card utilization.

What does the amount of loan payment depend on?

The loan payment amount depends on many variables, such as:

- loan amount,

- interest rate,

- loan term,

- installment type (variable/fixed),

- loan purpose (real estate/car/minor expenses),

- currency,

- additional insurance,

- fee, margin.

All these variables differ in every bank, but the loan calculator will allow you to calculate an approximate payment amount at home. This will make it possible to select a group of banks to visit first.

Why should you use the loan calculator?

The loan calculator is an absolutely free tool. When using it, you don’t bear any costs, which is the first important issue that should encourage you to use this tool. Secondly, the loan cost simulation is ready in an instant, so you don’t waste your precious time. Thirdly, you get a complete calculation of the full cost of the obligation you’ve chosen without any particular knowledge about loans. Thus, you find out what the monthly obligation cost will be, and thus will be able to determine whether this amount suits your capabilities. If the monthly payment is too large, you can use the calculator to change the selected parameters and adjust the payment amount to your solvency level. This will help you to choose the financing terms according to your needs and capabilities. You’ll be sure that the issued credit or loan won’t turn into a burden for your family budget.

How do loan calculators work?

In specific boxes of the calculator, you should enter information on the amount of the offer you are interested in. Calculators cooperate with a constantly updated database from particular banks and use specific data provided by you and related to the loan offer in question.

The corresponding algorithm used in the calculator will instantly convert this data and present it as a series of offers grouped according to the customer’s request. These can be offers grouped by only one criterion, which for example, can be the loan interest rate from the lowest to the highest, or grouped by a few criteria, such as:

- lowest fee,

- payment amount,

- maturity date,

- amount of all additional fees.

Indeed, you should keep in mind that calculations made in a particular bank may differ from the ones made using the calculator. The calculations provided give a general idea of the payment amount in particular banks, but nevertheless you should contact a bank representative.